2018/04/10

Irish Economic Backdrop

In many ways 2016 was a transitional year for the Irish property investment market. Admittedly, critical elements of the landscape remained largely unchanged from 2015. For example the Irish economy continued to perform very strongly with output expanding by 5.2%. This makes Ireland the fastest growing economy in the European Union. The labour market also continued its recovery contributing to a further improvement in the public finances. Reassuringly, according to consensus forecasts, these positives look set to remain in place for the foreseeable future. However while interest rates remain low it is becoming increasingly clear that the period of ultra-loose monetary policy is drawing to a close. The US rate cycle has already turned with the Fed tightening for a second time in December 2016. Unemployment is falling across the Euro Area and, with oil prices rising, inflationary pressures in Europe are building. As a result there is now a growing expectation that the ECB will also begin to tighten its monetary policy in the medium term. Indeed the first tentative signs of this are already evident with December’s announcement that the ECB will reduce its monthly bond-buying target from €80bn to €60bn from April 2017. In keeping with this the yield on Euro Area sovereign bonds has started edging out and the Irish 10 year rate has risen from 0.33% last September to 1.08% by mid-March 2017.

For now the outward drift in bond yields is being contained by the continuation of the ECB’s Quantitative Easing (QE) programme – while monthly bond purchases are being reduced the overall programme has been extended by nine months to December 2017. Consequently the monetary cycle has not led to a perceptible slowdown in Irish property investment. In our view, however, the direction of monetary policy does limit the scope for further yield compression in the current cycle.

2016 also saw a number of global developments that could potentially impact on the occupational demand for business space in Ireland. In August the European Commission ruled that Apple’s tax deal with Ireland amounted to improper State aid – a ruling that the Irish Government is appealing. Brexit and the surprise US election results also have the potential to impact on the market. The implications of these factors are difficult to predict in advance. However, although they introduce additional uncertainty, the consensus view is that Ireland’s economic growth prospects remain very favourable and this should continue to underpin the demand for business space.

Dublin Residential Market

The appeal of investing in Dublin’s residential market is underpinned by the city’s commercial success, which is complemented by its educational and lifestyle offering. Dublin is a dynamic, outward looking city, and home to the European Headquarters of many of the world’s leading companies including Google, Facebook, Twitter, LinkedIn and Microsoft to name just a few.

While a favourable tax rate acts as a significant pull factor, Dublin’s young, highly educated English speaking workforce is also of central importance for employers:

- 33% of the population is aged under 25, the highest rate in Europe

- 53% of 30-34 year olds have a degree, also the highest rate in Europe

- Ireland is ranked first in the world for being open to foreign ideas and also for flexibility when faced with new challenges according to the IMD World Competitiveness Yearbook.

The incentivised tax treatment that businesses enjoy also extends to individual investors. There are a number of fund structures that allow tax efficient investing through vehicles such as the Qualifying Investor Alternative Investment Fund (QIAIF), which is open to suitably qualified investors making a minimum initial subscription of €100,000. As a further incentive, the Immigrant Investor Programme has been established which allows non-EEA nationals and their families, who commit to an approved investment in Ireland, to secure residency status.

Strategic geographic position between Europe and the United States. The ease of investing in Dublin is facilitated by Dublin Airport, which offers excellent global connectivity due to its

Ireland was one of the worst affected countries of the Global Financial Crisis (GFC) as an overvalued residential market underwent a correction simultaneously as the GFC hit. In the aftermath, prices fell by almost 60% in Dublin, making it one of the worst housing crashes on record anywhere in the world. However, as it became clear that the market had substantially overcorrected, prices rebounded strongly, growing by over 68% although they remain 31% below peak. While rents did not fall as much as prices during the crisis, they have also witnessed heightened inflation and now stand approximately 10% above previous peak levels.

The Central Bank introduced stability measures at the start of 2015, which has seen price inflation moderate to 8.2% in the year to March. Other public policy measures introduced include the Government’s ‘Help-to-Buy’ scheme which will assist first-time buyers in obtaining a deposit for a new home by providing a rebate of income tax that has been paid over the previous four years up to a maximum of 5% of the purchase price of a new home valued up to €400,000.

The latter policy is aimed at boosting supply, with Dublin witnessing the lowest levels of housing delivery since records began in 1970. In 2016, just over 4,000 units were delivered despite an annual need for over 10,000 units per annum as identified by our research. As a result of the lack of construction, the stock of properties for sale and for rent is at its lowest ever point.

To compound issues, the purchase market has suffered from a dearth of finance with the value of mortgage drawdowns falling from €39.9 billion in 2006 to €5.6 billion in 2016 as bank funding reduced significantly following the economic crisis. This low lending figure is despite the market being driven by strong fundamentals with first-time buyers accounting for 46% of the mortgages obtained compared to 20% leading up to the crash.

Furthermore, buy-to-let investors now account for 3% of the market compared to approximately 20% previously which is a further sign that the market is being driven by positive fundamentals rather than unsustainable speculation.

The Dublin residential market represents a unique opportunity for investors to gain exposure to Europe’s fastest growing economy. In addition to being Ireland’s economic engine, accounting for 28% of the national population but 39% of national output, Dublin is also the focal point for Ireland’s population boom which will ensure a long-term demand for housing.

With the majority of advanced economies experiencing the dual forces of economic stagnation and aging populations, Dublin has stood out as a beacon of growth. In the process, the city has attracted the attention of the largest investment funds such as Singapore’s Oxley Holdings who are funding a mixed-use scheme extending to over 1 million sq ft in the heart of Dublin’s docklands. With indicators such as prices, rents and supply all pointing in a favourable direction from an investor’s point of view, the outlook remains bright.

These same dynamics have also raised the market’s profile for international individual investors who are also attracted by Dublin’s educational and lifestyle offering in addition to the aforementioned economic case. And while the residential market faces serious issues such as the difficulty in obtaining mortgage financing, this creates an opportunity for foreign buyers who are not hindered by funding obstacles. With both the residential market and the economy in the relative early stages of recovery, international interest is only set to grow.

Dublin Commercial Market

With office-based employment in Dublin growing at a spectacular 5.5% in 2016, occupier demand for business space remains strong. Just under 225,000 sq m of purpose-built space was let in Dublin last year – 26% above the 20 year average. Although this total contains 47,400 sq m of development pre-lets and a significant amount of churn, nearly 42,000 sq m of space was digested in net terms during the year. This brings total net absorption since the cyclical trough in Q2 2010 to more than 520,000 sq m. As a result the overhang of vacant space has been reduced to approximately 325,000 sq m – or 9% of the standing stock (compared with 22.8% at the trough).

With vacancy tightening prime headline rents have been rising since 2012. In Savills’ view the tone of rents at the top of the market stood at €646 per sq m (€60 per sq ft) per annum in December 2016. Rental inflation has slowed from a peak of 21.1% in 2015 to around 5% last year. However, to a large extent, this reflects the growing influence of pre-lets which are currently trading at a discount to rents on space for immediate occupation. It should also be noted that reduced rent-frees have led to faster growth in net effective rents than is indicated by the movement in headline rents.

Reflecting the continued strength of the occupational market offices remain firmly on many investors’ buy-lists. More than €1.5bn of office assets were sold in 2016 – accounting for over a third of the year’s investment turnover. Including office properties traded within portfolios, and mixed use buildings with a substantial office element, 109 assets changed ownership last year. Four fifths of these were located in Dublin.

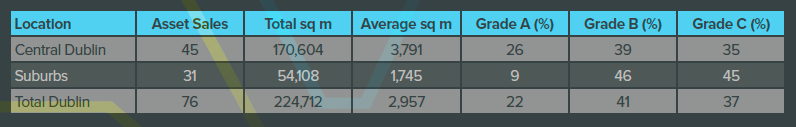

Within Dublin, 87 office buildings were traded – eleven more than in 2015. Seventy six of these were modern purpose-built blocks which, in aggregate, accounted for almost 225,000 sq m of space. This brings the total of modern office space traded in Dublin since the beginning of 2013 to more than 1.1 million sq m – almost one-third of the total standing stock. Over 700,000 sq m of this has been within the Central Business District (CBD) meaning that 42% of all the purpose-built space in Dublin’s prime business district has been traded in a hectic four year period. 1

Of the 76 modern office sales in Dublin last year, twelve were re-trades of assets bought earlier in the cycle. This brings to almost 30 the number of purpose-built Dublin offices that have been re-traded since the beginning of 2013, and most of these are now believed to be in the hands of longer-term owners. Given the increasingly stable ownership of prime properties, Grade A space has become harder to buy and accounted for a smaller share of the traded stock – 22% in 2016 compared with 29% in 2015 and 36% in 2014. This trend also reflects the aging profile of Dublin’s office stock. While newly completed space is beginning to emerge, and some older buildings are being refurbished, 83% of Dublin’s purpose-built office blocks are now more than ten years old. As a result, the average age of the purpose-built properties being sold has risen from 17.1 years in 2014 to 20.5 years in 2016.

Summary of Dublin Modern Office Investment – 2016

As shown in the table above, three-fifths of the modern offices traded in the capital last year were located in Central Dublin,2 with just under half of these in Dublin 2 – the city’s premier business address. The remaining 31 were located in the suburbs. Suburban activity was markedly up on 2015 due to four portfolio sales which together contained 16 suburban office assets – the majority of which were located in south east Dublin. However many of the suburban assets that traded were smaller buildings. Consequently the suburban share of total space traded fell from 26% in 2015 to 24% in 2016.